We see exchange rates in almost every application that provides financial services today. Trading platforms, banking applications, etc.

Many businesses in this field usually obtain foreign exchange rate data from an exchange rate API. With the data they obtain, they increase user satisfaction by providing users with the most up-to-date and accurate data.

But have you noticed that recently apps that offer historical exchange rates have become more popular?

It has become quite common nowadays to offer historical exchange rate data to users through the application.

By integrating an exchange rates API that offers this service into our applications, we can obtain both live and historical exchange rates and provide them to users.

In this article, we will discuss the use cases of historical exchange data, which is growing in popularity day by day. Then, we will introduce today’s best exchange rates APIs that provide this service.

What are the Top Use Cases of the Historical Exchange Rates API?

Historical exchange rates have many use cases today. Some of them are as follows:

- Risk Management: International companies use historical exchange rate data to successfully manage financial risks arising from fluctuations in exchange rates. In this way, companies can effectively minimize financial risks by creating risk management strategies.

- Currency Calculator: With the Historical exchange rates API, we can develop tools to calculate exchange rates from past periods online. Tourists, investors, and businesses can use this tool to easily learn and calculate exchange rates from past dates.

- Currency Trend Analysis: Investors and traders can analyze the trends of specific currencies over time using historical exchange rate data. With this analysis, they can make more informed decisions by knowing the strengths and weaknesses of currencies.

- Financial Modeling and Simulation: Financial analysts and modeling experts use historical exchange rates to build financial models and simulate future scenarios. With this data, companies can assess their risks and predict future performance.

- Monetary Policy Analysis: Central banks and economists use historical currency data to understand the effects of monetary policy. This analysis helps them make more effective and balanced decisions by assessing the impact of monetary policies on the economy.

Best Historical Exchange Rates APIs

In this section, we will introduce the best exchange rates APIs that provide today’s historical exchange rates.

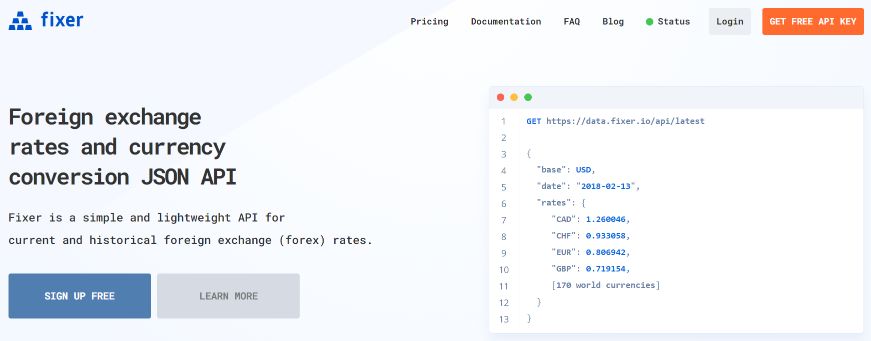

Fixer API

Fixer is one of the best exchange rate APIs on the market right now. Fixer API provides us with both live and historical exchange rates for 170 currencies today. It provides historical data back to 1999 and supports conversion between historical currencies.

Moreover, we get the most up-to-date and accurate data for these currencies with a single API request. Fixer API obtains its data from official financial institutions such as the European Central Bank. It also updates its data every 60 seconds.

Finally, the Fixer API is used by more than 200,000 companies and developers, including companies serving users in multiple countries, such as Microsoft, Kranken, Samsung, and Bershka.

Fixer API has multiple subscription plans. The free plan is one of them. It offers a generous limit of 1,000 API calls per month. In addition, its paid plans are only $13.99 per month, with annual payments for 10,000 API calls.

Also Read: How to sign up to StackPath free trial?

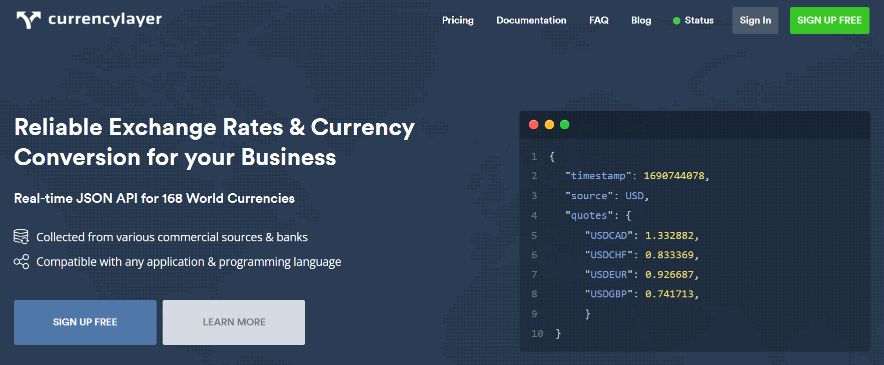

The currencylayer API

The currencylayer API is a highly reliable exchange rates API that provides historical currency data. It supports 168 official currencies and precious metals. The currencylayer API provides historical data for 168 currencies going back 19 years.

The currencylayer API, which has multiple endpoints, works very fast. In this way, applications using this API will not encounter any performance problems. It is an easy-to-integrate API. It also provides data in JSON format.

So we can easily parse it in any programming language. Finally, the currencylayer API has high-quality technical support. This means that users using this API can quickly get technical support anytime.

The currencylayer API has one free and three paid plans. Its free plan is limited to 1,000 requests. The paid plans start at just $13.99 per month for annual purchases.

Xe Currency Data API

Xe Currency Data API is the API that provides exchange rate data used in many websites and mobile applications in the market. Xe has 30 years of experience in the industry. For this reason, it is known as one of the most reliable foreign exchange APIs in the industry.

This API provides live foreign exchange rate data as well as historical exchange rate data. It supports more than 220 official currencies. It is a very easy-to-use API, and its documentation is quite comprehensive.

The first of the paid plans of the Xe Currency Data API is the ‘Lite’ plan. With this plan, we have to pay only $799 per year for 10,000 requests per month.

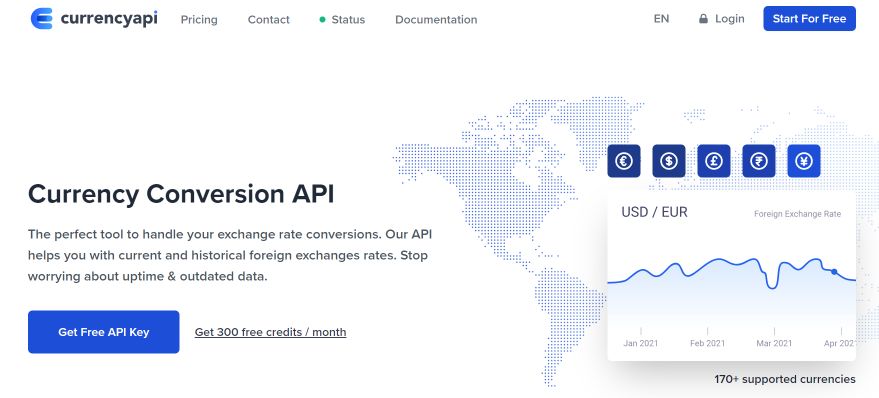

The currencyapi

The currencyapi is another popular exchange rates API on the market that provides historical exchange rate data. This API updates its data every minute. This ensures that we are always trading with the most up-to-date data. The currencyapi supports more than 170 currencies.

It is actively used by Heineken, SAP, Coca-Cola, and many other popular businesses. It has bank-level security and obtains data from highly secure data sources. It also provides sample integration codes for popular programming languages such as JavaScript, Python, and PHP in its documentation.

The currencyapi has a free subscription plan with a limit of 300 API calls per month. Moreover, its paid plans start at just $9.99 per month for 15,000 API calls.

Conclusion

As a result, the use of historical exchange rate data by financial institutions serving their users with foreign exchange data has become quite popular. With historical exchange rates, they allow us to make various analyses about currencies.

The accuracy of the data provided by financial institutions or trading platforms that offer historical exchange rates is very important. They should serve their users using popular services in the market.

Also Read: How to Start Sirius Xm Free Trial

FAQs

Q: What is the Historical Exchange Rates API?

A: Historical exchange rates API is a programming interface that provides access to historical exchange rates data and presents them to the client.

This API accesses historical exchange rate information from various data sources and is used as a valuable resource for financial analysis, currency conversion, and various other uses.

Q: What are the Common Use Cases of the Historical Exchange Rates API?

A: Historical exchange rates API is used in many areas and for many topics today. Some of them are as follows:

- Risk Management

- Currency Calculator

- Currency Trend Analysis

- Financial Modeling and Simulation

- Monetary Policy Analysis

Q: What are the Popular Historical Exchange Rates APIs?

A: Some of the popular historical exchange rates APIs are:

- Fixer API

- The currencylayer API

- Xe Currency Data API

- The currencyapi

Q: Until What Date Does the Fixer API Provide Historical Exchange Rates?

A: Fixer API supports historical exchange rates of 170 official currencies until 1st January 1999. In addition, it also provides highly accurate and timely live foreign exchange rate data. It obtains the live foreign exchange data it provides from official financial institutions and updates it every 60 seconds.